"Nigeria and Africa has a massive network effect that have not be fully utilized. With Nigerians/Africans in every country and territory of the world, we can scale an African business to 100+ countries in few weeks"

Daniel Izeghs Oratokhai

Managing Partner at SINC Partners LtdBuilding the future together, democratizing success.

SINC Partners has a novel vision of making success available to everyone and democratizing the pain point of success. We are a next generation startup studio focus on building and supporting enterprises at scale and we help them raise service investments and funds across 3-5 deals from as low as $25k at start to up to $15m before you leave the lab. We are a Gasus Business, a business built on the foundation of Christian values and belief.

Our Area of Focus

In our quest to help make success available to everyone, we have initial strategic direction to focus on these five (5) key areas at the lab

Business Support & Incubation

On-Demand & As-A-Service

Marketplace & Crowdsourcing

Aggregation & Shared Economy

Decentralized Economy & Digital Assets

Our Concept Innovations

We have proprietary concept innovations that will support the startup ecosystem, support solution-providers/entrepreneurs and ultimately help democratize success;

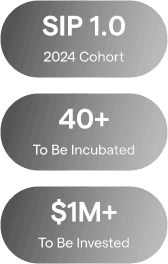

Service Incubator

A service-for-shares model of incubating pre-product startups and early-stage companies by building their early stage product and MVP

Virtualting

A resource share model that allows companies share the time of resources (employees, consultants, technical advisers or influencers) while also splitting the service cost of the resource

Diiming

A progressive investment model that allows you to put aside income (disposable or non-disposable) as investment over a period towards an investment or spend of your choice

Our Service Incubation Model

The Service Incubation model is an alternate funding model for startup that allows professionals to offer their services to startups in return for a minute equity (usually between 0.5% to 1.5%) in the startup. As a service incubator, you will see your share grow as much as 1000% in 12 – 24 months as been first to invest.

Hypothesis

Just a few reasons we know its time for this model within the ecosystem

Most early-stage companies and pre-product startups cannot afford professional services especially those who don’t have family and friends’ network that can support

If startups can seed 5-10% in equity to incubators for $20k to $200k funding most times, they will be willing to seed 10% equity for a $25k service investment

Young professionals who don’t have a lot of money to invest nor an accredited investors will have opportunities to take equity at the early stage of their career, usually been the first to invest and almost guaranteed of return

Case Study

See what Service Incubators get, the maths behind Service Equity (SEEQ) and what the value of your share equity can be over time

Our Studio Portfolio

Our 2024 Service Incubator Portfolio Companies

Co-found With Us

We seek to collaborate with visionary individuals who are solving similar problems of helping entrepreneurs succeed

We Ideate

We internally generate concepts and ideas that help solve problems in our thesis areas, after which we proceed to develop a nano/micro MVP (usually having as low as 30 functions to as high as 100 functions) of the product that we take to the market.

You Validate

You join our 3 months inResidence program as a business expert to run the operations or as a technical expert to further the development and validate the idea with an average monthly revenue of $1k or 10,000 users and/or an MVP of at least 150 functions

You Co-own

After successful validation and demo day at the end of the EIR program, we move those with perfect fit to become co-founders of the product they validated as CEO & CTO, each owning 20% of the venture.

How It Works

Our EIR program is our structured 3 months un-paid program designed to help us have a pipeline of business and technical cofounders who can run the venture of choice as CEO & CTO owning 20% equity each.

Application and Selection

Begin your journey by completing our straightforward application form. Share insights into your entrepreneurial background, expertise, and your vision for supporting the success of our portfolio companies.

Our dedicated selection committee, comprised of key stakeholders at SINC Partners, will carefully review your application.

Alignment Meeting and Proposal Submission

If your application stands out, we'll invite you to an alignment meeting. This is an opportunity to discuss the goals of our EIR program and explore how your expertise aligns with the needs of our portfolio companies.

Following the alignment meeting, submit a formal proposal outlining your intended contributions and how you envision adding significant value to our portfolio companies.

Negotiation and Agreement

Upon successful alignment and proposal review, we'll engage in discussions to finalize the terms of your EIR role. This includes the duration, expectations, and any compensation or equity arrangements.

Once terms are agreed upon, we'll draft a formal agreement outlining the specifics of your EIR engagement, including reporting structures, responsibilities, and the support/resources provided by SINC Partners.

SINC Investors Network

Our deals are structured not just to take in investments but to onboard owners passionate about our solutions. Our portfolio companies are valued at $50k at start, with these low valuation, you are guaranteed at least 2x-5x, usually been the first to invest.

Disclaimer: These deal flows is a statement of our projections and may differ from stage to stage and from venture to venture and the guarantee is for deal 1, usually the first to invest

Micro Angel Investors & Service incubators (Invest from $500 & above)

Deal 1

✓ Idea Stage: $5k for 5% Equity

✓ Expected Revenue at This Stage: $0/mth

✓ Duration of Raise: 1mth

✓ Who Can Invest: People with Domain Expertise and Advisors

Deal 2

✓ Build Stage: $25k worth of service for 10% Equity

✓ Expected Revenue at This Stage: $100+/mth

✓ Duration of Raise: 1-3mths

✓ Who Can Invest: Developers, Engineers, Growth Marketers

Deal 3

✓ Validation Stage: $50k for 5% Equity

✓ Expected Revenue at This Stage: $1k+/mth

✓ Duration of Raise: 3-6mth

✓ Who Can Invest: Everyone

Deal 4

✓ Traction Stage: $125k worth of service for 5% Equity

✓ Expected Revenue at This Stage: $5k+/mth

✓ Duration of Raise: 6-12mths

✓ Who Can Invest: Media, Influencers, Celebrity, Platform Owners

Angel Investors & Venture Capital (Invest from $50k and above)

Deal 5

✓ Pre-seed Stage: $1.5M for 10% Equity

✓ Expected Revenue at This Stage: $50k+/mth

✓ Duration of Raise: 6-18mths

✓ Who Can Invest: Angel Investors, VCs, PE, Institutions

Deal 6

✓ Seed Stage: $7.5M for 20% Equity

✓ Expected Revenue at This Stage: $250k+/mth

✓ Duration of Raise: 12-24mths

✓ Who Can Invest: VCs, PE, Institutions

Deal 7

✓ IPO Stage: $1.5B for 20% Equity

✓ Expected Revenue at This Stage: $1M+/mth

✓ Duration of Raise: 18-36mths

✓ Who Can Invest: The Public

Work with Service Incubators (SINC) to expedite your time to market

Equity jobs

See companies and startups offering equity or a mix of cash and equity for very important position in their company

This company is a SAAS Startup that builds AI copy generator...

Chief Executive Officer

LOCATION

Abuja, Nigeria

INDUSTRY

On-demand print

EQUITY

1.2%

STIPEND

NGN 200,000/mth

DEADLINE

24th, January 2024

ROLE TYPE

Full-time

This company is a SAAS Startup that builds AI copy generator...

UX Strategist

LOCATION

Abuja, Nigeria

INDUSTRY

E-commerce

EQUITY

1.2%

STIPEND

NGN 200,000/mth

DEADLINE

24th, January 2024

ROLE TYPE

Full-time

This company is a SAAS Startup that builds AI copy generator...

CTO & Head of innovations

LOCATION

Abuja, Nigeria

INDUSTRY

Fintech

EQUITY

1.2%

STIPEND

NGN 200,000/mth

DEADLINE

24th, January 2024

ROLE TYPE

Full-time

This company is a SAAS Startup that builds AI copy generator...

Backend Developer

LOCATION

Abuja, Nigeria

INDUSTRY

Transportation

EQUITY

1.2%

STIPEND

NGN 200,000/mth

DEADLINE

24th, January 2024

ROLE TYPE

Full-time

Blogs & Resources

Top Ten Most Powerful Startup

Top Ten Most Powerful Startup. Top Ten Most Powerful Startup. Top Ten Most Powerful Startup

Top Ten Most Powerful Startup

Top Ten Most Powerful Startup. Top Ten Most Powerful Startup. Top Ten Most Powerful Startup

Top Ten Most Powerful Startup

Top Ten Most Powerful Startup. Top Ten Most Powerful Startup. Top Ten Most Powerful Startup